One common pitfall for growing businesses is a lack of focus on financials. Marketing strategies and product development are undoubtedly exciting. Still, more often than not, it’s the diligent work of finance and accounting teams that keeps the business on track and moving full steam ahead.

If you’ve gotten by so far without financial forecasting, you may ask, “What’s the worst that can happen?”

The answer is “a lot” — and potentially at the worst moment. Absent or incomplete financial statements and forecasting can cause cash flow disruptions, inventory shortfalls, slow disaster recovery, reduced valuations, and problems obtaining credit.

Solid forecasting doesn’t have to be elaborate, but it should be consistent, comprehensive, and data-driven. Today, we’re covering some basics of financial forecasting and budgeting and sharing ways to improve your financial reporting.

With the right approach, you can move toward stronger financial positions and smoother operations through the inevitable peaks and valleys of running a business.

By the end of this article, you’ll know:

- What financial forecasting is and how it works

- The benefits of strong, consistent forecasting and budgeting

- How technology can boost financial forecasting.

First, let’s define forecasting and budgeting a little better.

Download the ebook: How to Show Your CFO You're Saving Money

What is financial forecasting?

Financial forecasting is the process of using past financial data and current market trends to make educated assumptions for future periods. It is an important part of the business planning process and helps inform decision-making.

Effective forecasting relies on pairing quantitative insight with creative evaluation. Taking what you know and what you believe could happen near term, you can plan for what comes next.

Forecasting factors in expected events such as predictable economic changes or business expansions. It also attempts to establish contingency plans for unforeseen events such as stock market corrections, natural disasters, or long- or short-term business disruptions.

While forecasting cannot predict or avoid every pitfall — for instance, a global pandemic — it can ease the impact of outlier events and create opportunities for growth during advantageous periods.

Forecasting vs. budgeting

There are different financial forecasting models, each with distinct features and potential benefits. (It’s important to note that what many people call forecasting is actually budgeting.)

Every business is unique and will benefit from different types of forecasting models. In general, businesses operate using either:

- A traditional, static budget that forecasts expected revenue and expenses in a single time period — typically 12 months. In this approach, the projected revenue and expenses are amended over the current period, but the time horizon remains fixed. Amendments during the forecast period happen in smaller increments as your approach period end. This forecasting process is sometimes called forecasting “to the wall.”

- Rolling forecasts take a dynamic approach to financial planning. Instead of making budget allocations and setting goals once per year, forecasting is conducted over shorter periods (often quarterly) and reviewed during each period for potential adjustments. Planning is continually added to the end of the forecast horizon. This dynamic approach to forecasting allows companies to engage in a less-intensive yet consistent forecasting and budgeting process. It is especially helpful for handling higher-variability scenarios such as fluctuating inventory and seasonal cash flow.

Why is financial forecasting important?

Forecasting is the basis of every financial decision your company will make in a given time period. Strong financial forecasting practices tend to lead to better financial outcomes, more stable cash flow, and better access to the credit and investment that can help your business grow.

With a forecast in place, department heads can more effectively plan spending for their teams. Procurement and supply chain teams can plan capacity, manufacturing, and distribution. Sales and marketing professionals can develop metrics and reasonable sales targets based on the information analysis

Forecasting also serves as an important barometer for the overall health of your financial organization. As the fiscal year progresses, having well-documented forecasting can illustrate the effectiveness of current revenue-generating strategies, contextualize current performance, evaluate the market’s effect on your financials, and help identify and correct areas of misalignment.

Forecasting serves your business decisions by:

- Providing the basis for budgeting: As we said before, forecasting and budgeting are often used interchangeably. But in reality, they are two separate processes with different goals. Forecasting is the first step of overall financial planning. It considers known data and uses that to predict and influence future, unknown events.

- Creating necessary accountability: Having a documented plan also creates benchmarks for evaluating the progress toward your financial goals. As Peter Drucker famously pointed out, “What gets measured, gets managed." Successful spend management is one of the most important ways to ensure stable financial performance over time.

- Informing strategic decisions: With access to data and a well-reasoned future plan, stakeholders can make better decisions about the strategies and investments they make. Forecasting is the way to ensure that decisions are made based on accurate historical data and properly modeled future potential.

- Improving risk evaluations: Part of financial forecasting includes finding ways to mitigate unforeseen circumstances and create contingency plans for outlier scenarios. While you can never fully mitigate risk, imaginative scenario-building can reduce liability and improve recovery from unforeseen financial events.

- Facilitating planned, consistent growth: Successful growth shouldn’t be left to chance. Forecasting models grounded in solid data and assumptions can offer insights to create cost-cutting and growth opportunities. This can help you optimize spending, so more of your dollars go into revenue-generating activities.

Basic elements of financial reporting

The basis of your financial forecasting and reporting efforts will come from the three financial statements: the Balance Sheet, the Income statement, and the Cash Flow statement. These pro forma documents interconnect to reveal a holistic view of your company’s financial life.

- Income statement: Shows business performance across periods. The Income statement reflects vital signs like revenue, cost of goods sold (COGS), gross profit, expenses, pre-tax earnings, and net earnings.

- Balance Sheet: This is a report of the assets, liabilities, and equity over the preceding forecasting period. It is a point-in-time financial snapshot of the company.

- Cash Flow Statement: This shows the cash movements in your business. The purpose of this statement is to show the net change (increase or decrease) in cash balance over each period.

Five areas to review in financial modeling

When constructing any type of financial forecast, there are certain factors you’ll want to include in your reporting. Some, like past financial data, are concrete and easily contextualized. Others rely on advanced expertise to successfully identify and model outcomes.

Five of the most important factors in a forecasting exercise are:

- Historical data: Past financial performance is the cornerstone of forecasting. Examining your financials through previous forecasting periods will surface growth opportunities. This data is your most accurate starting point for making future projections.

- Forward-looking projections: Depending on your business and reporting method, your time horizon may vary from a year to two years. These projections should attempt to predict future revenue goals, new business opportunities, and other positive impacts.

- Expense and cash flow forecasting: Your forecast should attempt to evaluate expected expenses based on current company objectives, adjusted for consequences like inflation and increased goods and services costs. The better your procurement data, the more accurately you can forecast these expenses.

- Best/worst-case scenario planning: Financial modeling is not just about statistical analysis, but creative thinking. Therefore, thorough forecasting should explore different scenarios and outlier events. This includes adverse events — such as fires, location closures, cyber attacks, and natural disasters — and positive events such as higher-than-expected revenue, investment returns, etc.

- Risk analysis: Part of your contingency planning should consider liability caused by internal and external forces. While contingency planning for outside risk sources is essential, it’s also necessary to plan for internal risk factors such as employee malfeasance, lawsuits, and crisis events.

How technology improves financial forecasting and budgeting

Understanding the impact your variable costs have on expected revenue is the best step in creating more accurate forecasts for your company.

The right software can make forecasting easier by helping you visualize expenses over time. This makes it easy to see where you’re spending your money, in order to predict future spending and unforeseen circumstances.

- Procurement often represents the lion’s share of company expenses. Using an automated procurement tool can help organizations to find cost-savings opportunities within their current purchasing process. By centralizing your data and viewing results in real-time, you will gain granular spend visibility and context for expenses. This level of detail makes projecting future expenses easier.

- These technology tools also help users streamline vendor and supply choices to reduce spending. Using curation in your purchasing saves money in the short term while stabilizing monthly invoices and creating a more consistent view of expenditures.

- Processing invoices and payments can be time-consuming. By using a tool with Integrated payments systems, stakeholders can get what they need, and accounting can buy and pay for it faster. Using a procurement software tool, users can automate invoicing to avoid penalties and realize early payment discounts. Improving your budget efficiency leaves more room in the budget for revenue-generating activities and strategies.

Using a procurement tool like Order.co, you can harness the power of data you already produce every day. Doing so can significantly improve the accuracy and effectiveness of your financial forecasting.

If your organization is ready to improve financial forecasting through better procurement management practices, schedule a demo of Order.co.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Imagine walking into the office on a Monday morning, and your desk is buried in invoices.

You spend the next week manually uploading each one. You barely have time for a coffee break because the piles never actually go away. You keep at it because that’s your job, and that’s how your company manages invoices. But you know that next week, next month, your desk will look exactly the same.

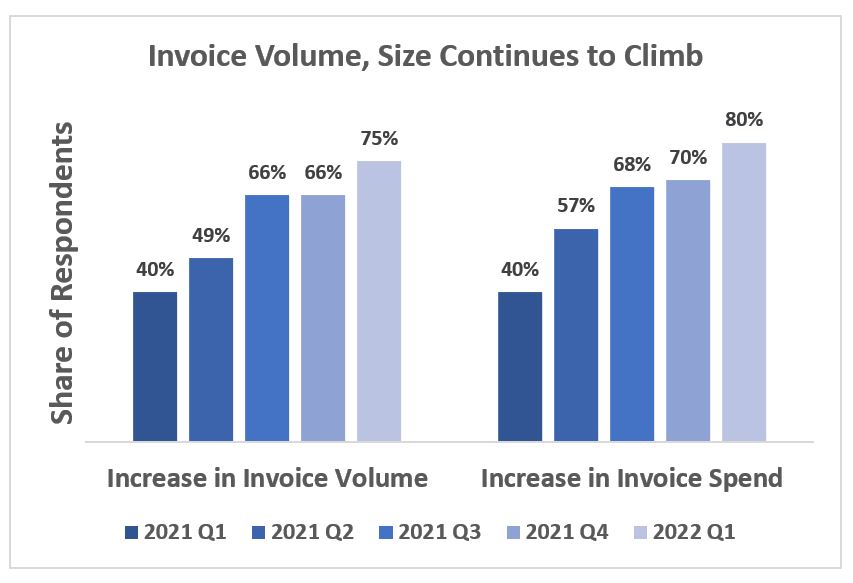

This is reality for thousands of AP professionals. Half of the respondents to a recent IOFM survey say they are working longer hours to keep up with the rising volume of invoices. According to the data, things won’t let up anytime soon. The same report showed that invoice volume increased 75% in Q1 of 2022 alone.

Download the free tool: Invoice Tracking Template

This Increase in volume and associated work are leading many accounts payable (AP) professionals to burn out, with one in four of these overworked individuals considering leaving the field as a result. Additionally, one in five AP professionals is approaching retirement age. In total, nearly 50% of the professionals surveyed are at risk of leaving the industry.

Growing a company is hard enough. Proper invoice management is a vital practice for your company and your valuable employees. Before we hop into how to fix invoice management at your company, let’s first get into what exactly invoice management is—or at least what it’s supposed to be.

What is invoice management?

Simply put, invoice management is a process by which a company receives, organizes, validates, pays, and records supplier invoices, in that order.

Seems easy, right? It is, but believe it or not, proper invoice management isn’t as common as one might think. If you’re not careful, poor invoice management can plague your company’s growth and bottom line. In truth, no industry is immune to this issue.

What is the manual invoice process?

The core problem with invoice management is not the invoices themselves. Companies have to purchase products—that’s a given. For many companies, even in today’s world, the problem with invoices is the manual process by which they’re managed.

Each invoice flowing into the company follows a process. They must be:

- Entered into the system

- Processed and coded

- Matched against purchase requisitions and purchase orders

- Approved and submitted for payment

- Tracked and reconciled at month-end

Ask anyone in finance— manual invoice management is a lot of work. Not only that, if you don’t keep the hundreds of paper invoices organized, like Donnie Brasco says, “Forget about it!”

The vicious cycle of poor invoice management

There is a vicious cycle when it comes to manual invoice management—especially as it relates to new and growing companies.

Growing companies buy a lot of products, especially those engaged in expanding locations. With those growth-necessitated purchases come corresponding invoices. The invoices are entered manually—given they’re not misplaced beforehand—to be approved.

After approval, payments are often made via paper checks through the mail. The payments are reconciled and recorded in a spreadsheet. The wealth of information contained in the purchasing process is ignored.

A new month of purchasing begins, and the cycle repeats itself.

The time and effort it takes AP teams and finance departments to facilitate improper invoice management takes away from the effort they could invest in strengthening their department and helping spur company growth.

Without sufficient effort focused on helping the growth of the company, it’s virtually impossible to gain traction. Nonetheless, the outdated manual invoice management process stays the same, and the cycle continues.

Top 5 impacts of manual invoice management

Manual processing can present a host of negative impacts for organizations. These are the five most damaging:

1. Poor visibility: Manual invoice processing relies on outdated data collection methods such as spreadsheets. These manual organization methods offer no options to dynamically search through or contextualize data. This lack of visibility makes it harder to find issues as they arise, and it also robs decision makers of access to valuable information for future planning and analysis.

2. Frequent errors: Everyone makes mistakes, and overworked AP staff are bound to make their fair share. Manual entry creates an average exception rate of up to 23%. As many as one out of every five invoices has an error that either requires research and remedy or never gets detected at all. Those exceptions can add up to considerable lost revenue and time.

3. Slower processing: AP clerks can only type so fast. A skilled clerk can process an average of 5 invoices per hour. For companies generating thousands of invoices per month, the headcount required to process everything in a timely manner is prohibitive. Additionally, the manual accounts payable process usually goes hand in hand with paper checks, which leaves suppliers waiting on snail mail to receive payments. Missing or delayed mail may generate late fees.

4. Higher processing costs: It’s expensive to perform manual data entry. Its expenses come from a variety of places:

- Increased labor cost

- Late payment fees

- Invoice exception costs

5. No scalability: The most pervasive problem with manual processing is the lack of scalability. With only so many hours in the day and so many people available to process, manual entry means the problem gets worse over time. For growth-minded companies, scalable systems are the key to success. That’s hard to accomplish if your AP team is constantly falling further behind.

AP automation can keep up with your company no matter how fast you scale.

What does good invoice management look like?

Manual invoicing can seriously weigh down the finance department. Fortunately, there’s a better way. Automated invoice processing software converts invoice management from a days-long, high-touch process to an instantaneous, touchless event. It can streamline every step of invoice batching, matching, and processing to reconcile thousands of invoices per hour. Here’s how it works:

Batching/receipt: Invoices flow into the organization from one of several channels (mail, email, or e-invoicing). Optical character recognition (OCR) scanners batch and digitize paper invoices, and invoice data is integrated into the system. Email and electronic billing go into the system automatically for validation and processing.

Reconciliation and matching: Formerly tedious processes such as invoice reconciliation and three-way matching between the purchase order, invoice, and purchase requisition happen automatically. These processes occur within the system at the time of invoice processing, eliminating the need for manual checking and re-checking of vendor payments against spreadsheets.

Approval: Invoice approval is automatically routed through approval workflows so any relevant stakeholders (for instance, finance or procurement) can sign off. The entire process happens within the system, eliminating the need for back-and-forth communication that slows down the process.

Payment: Using an integrated electronic payment method linked directly to accounting systems, the platform approves the invoice and issues an electronic payment directly to the supplier. This enables cost-saving early payment discounts.

Reporting and archiving: All centralized data is available for real-time reporting and analysis purposes. AP or other stakeholders have the ability to dynamically search for information by time period, vendor, category, department, or other search criteria.

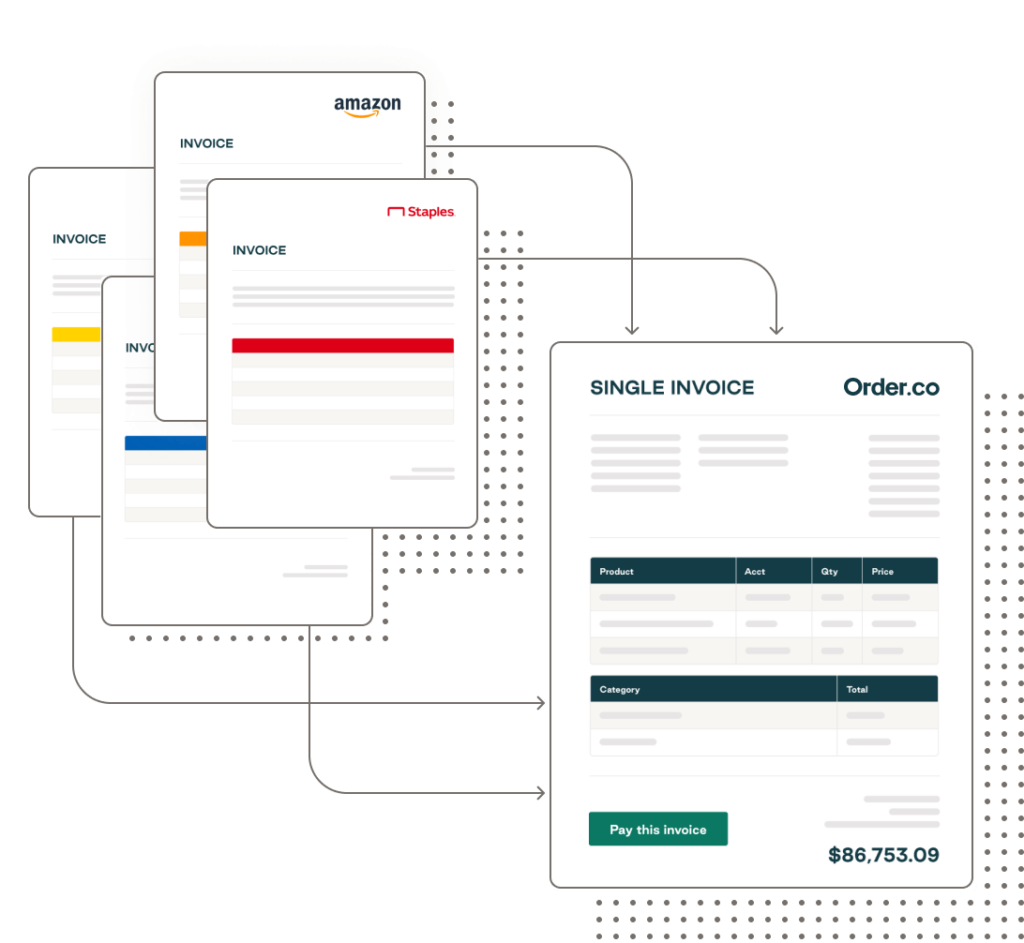

Invoice management software can help you achieve all this and more. The best platforms can also help consolidate billing and payment into a single, automated event, saving AP hundreds of hours of work in researching and paying vendors. Instead, a single click can pay them all.

Real-life examples of effective invoice management

Let’s get some real-life examples of how consolidated invoicing and proper invoice management drastically increase the productivity of finance teams and foster the exponential growth of companies.

Cutting down on the number of invoices your company has to process saves your team and company time and money. With consolidated invoices, companies can go from hundreds or thousands of invoices to just a few—or even a single invoice—every month.

Elliot Physical Therapy gets better process efficiency

Elliott Physical Therapy discovered the time and money they could save by using consolidated invoices and efficient invoice management. Finance Director Caroline Dodero calls it a “huge time saver” that “allows [Elliott PT] to focus on higher-level projects” rather than wasting numerous hours every week organizing hundreds of invoices. They are now able to pay 168 separate invoices with one click.

Clinton Management gets payments under control

Getting a call from a vendor who says your payment is late is just awkward. Clinton Management, a property management company based out of New York, suffered this exact problem. They were trying to manage hundreds of separate invoices, which led to backlogs and overdue payments. By consolidating their invoices and keeping track of their payments, they became the gold standard for both property and invoice management.

“Our vendors aren’t calling to ask where their payments are anymore,” explains Purchasing Manager Nadia Nizam. When you consolidate all your invoices into one, paper stacks go away, and you can see exactly whom you owe and ensure they are paid on time.

Free yourself from invoice management with Order.co

Order.co consolidates your invoices and automates many of the manual processes that bog down invoice management. The platform centralizes invoice management and brings you a competitive advantage, free from the chaos of keeping track of invoices. Never again will you ask, “Where did I put that invoice?” or “Did I pay that vendor yet?”

Establishing a good invoice management process is an essential part of scaling your business—without it, you’ll be stuck in the vicious cycle of invoice overload, with no clear way out. For companies looking to tighten up their invoice management system (and let their finance teams sleep better at night), that’s where we come in.

Order.co’s invoice automation features help some of the world’s fastest-growing companies streamline their invoicing and payment processes. Reduce manual entry, increase productivity, improve invoice management, and consolidate payments, all within one robust automation software tool.

Schedule a demo with one of our team members if you’d like to see exactly what Order.co can do for your business.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

As one of the biggest sources of liabilities on the balance sheet, accounts payable accruals can spur your company’s growth—or hobble it. Accurately tracking and maintaining your accounts payable balance prevents cash underruns, unwanted fees, and friction in your procurement process, all of which destroy progress.

Finance's accounting method may also impact the accuracy and stability of your financial reporting. For example, since it's straightforward, many small businesses and startups run financials using the cash basis of accounting. But as a business becomes more complex, a more accurate and compliant accrual method of accounting is preferred.

In this article, we’ll discuss the accrual method of accounting and the importance of accounts payable accruals in maintaining stable and accurate financials for your business. By the end of this article, you’ll understand:

- Cash versus accrual basis of accounting

- The importance of accruals to your accounts payable reporting

- Tips on managing accounts payable accruals

- How procurement software helps maintain accurate AP accruals

First, let’s clarify the difference between cash and accrual basis of accounting.

Download the free tool: Invoice Tracking Template

Accounting methods and terms explained

In its simplest form, accounting is the process of recording the money a company makes and spends.

- Money made (from any source) is called revenue. Revenue is the gross income a business makes before it subtracts expenses.

- Money spent (for any purpose) is called an expense. A company generates expenses for overhead (general business costs), wages, materials, and production.

There are two methods an accountant or CPA uses to record the money coming into and out of a business. These are called the cash basis of accounting and the accrual basis of accounting.

The cash basis of accounting works as follows:

- When you receive money, you record it as revenue.

- When you spend money, you record it as an expense.

While this is a simple way of looking at financials, the cash basis isn't accurate enough for businesses with more complex financial activity. Cash basis accounting does not meet the standard for Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

These businesses use the accrual basis of accounting:

- Income is recognized when earned. This may or may not be when you are paid. For instance, you might receive payment via a yearly contract with quarterly retainer payments.

- Expenses are recognized when they are incurred. This may or may not be when you pay the invoice. For instance, you may order inventory on credit to be delivered later.

Why should you use the accrual basis of accounting?

The reality of business transactions is that bills aren’t always paid as soon as services are rendered or products are delivered. But a large bill to be paid later still affects your company’s financial picture.

Cash basis accounting records a change only when the bill is paid. With accrual accounting, revenue and expenses are recorded when they occur—rather than when payment is made.

Even if a short-term liability isn’t due to be paid for 60, 90, or 180 days, it still appears on your balance sheet as a liability, so you know it’s on the horizon.

This gives you a clearer picture of your accounting. But it also makes things a little more confusing and requires extra bookkeeping.

In accruals basis accounting, you must reconcile credit and debit information for accounts receivable (revenue) and accounts payable (expenses) at the end of the accounting period.

Adjust the balance sheet when payment is made to ensure it matches what was previously recorded by creating a journal entry to adjust the general ledger (GL). These adjustments are called accruals.

Tips on managing accounts payable accruals

To understand accounts payable accruals further, let’s focus on expenses recorded under the accrual method.

Some of these are consistent, ongoing expenses. The cost of utilities and upcoming employee wages are examples of these expenses.

Goods or services provided by a third-party supplier may also be consistent and ongoing, but these are accounts payable accruals. Accounts payable refers specifically to short-term debts (those repayable within 12 months) owed to vendors. This differs from notes payable, which refers to long-term debts whose payment occurs over a longer period.

Like accrued liabilities such as loan payments and wages, accounts payable count as current liabilities. But often, these payments are harder to track and reconcile than recurring, predictable expenses like payroll or loan payments. Developing an effective strategy for these is essential to avoid running afoul of financial regulations.

Let’s look at how a business can take steps to improve the accuracy of its accounting.

1. Verify the accrual invoice, vendor, and goods

Accuracy and timely delivery of orders are essential to maintaining strong financial performance. When ordering supplies, services, or products, it’s important for purchasing and AP departments to verify and reconcile the goods delivered against the goods ordered.

This process is called three-way matching. It verifies that the purchase order, invoice, and receipt of goods (sometimes called a bill of lading) all match—including price, terms, item quantity, and item quality.

2. Increase scrutiny on large orders and unknown vendors

When working with or processing invoices from a new or unknown vendor, take time to verify that the invoice is tied to an actual order that has been received, accepted, and reconciled. Not only does this increase the accuracy of your financial statements, but it also detects and prevents procurement fraud.

Another way to prevent fraudulent activity is to segregate reconciliation duties in your organization. Different employees should review accrued expenses, adjust entries, reconcile orders, and verify vendor information. An accounts payable audit program improves accuracy and dissuades bad actors from perpetrating fraud.

3. Make review part of month-end close activities

Month-end closing is vital to the financial health of your organization. A robust month-end close process covers all the bases with your vendors and short-term liabilities. Reviewing your cash accounts and accurately reconciling AP and AR accruals is key to a smooth month-end close. This practice ensures the numbers accurately reflect your current financial position.

- A robust month-end close process reduces the time-to-close, saving money and allowing AP teams to focus on other high-priority activities.

- Accurate month-end closing figures translate to strong and accurate financial statements.

- Accurate financial statements empower business growth through stabilized cash flow, access to loans, and attractiveness to potential investors.

How Order.co manages AP accruals

The accuracy of your company’s income statement, balance sheet, and cash flow statement relies on accurately keeping track of your short-term liabilities. If you don’t properly track and reconcile expenses, your end-of-the-year financial outlook will not accurately reflect how your business performed.

Procurement software automates that workflow and removes human error. Using Order.co to automate and streamline purchasing:

- Enables automatic approval, purchase order, and three-way matching workflows to ensure accuracy of purchases and payments

- Reduces human error and procurement fraud that damage financial performance

- Creates an accurate record of your purchase history, spend management, and procurement reporting for future analysis

- Centralizes data used for reconciliation and financial reporting at month end

Would you like to learn more about using procurement software to make managing accounts payable accruals easier? Schedule a demo of Order.co today.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

What is 3-way matching?

Essentially, 3-way matching is a process in accounting in which a company verifies that a purchase order (PO), supplier invoice, and goods receipt all reflect the same products and pricing. If the numbers are consistent throughout each document, wah-lah! You’ve got yourself a 3-way match! With the green light of a 3-way match, payment is then issued to the supplier.

3-way matching plays two critical roles in your accounting operations:

- They prevent fraudulent charges from being charged to a company’s account

- They prevent companies from reimbursing unauthorized purchases

As you can imagine, doing this process by hand—especially if your company orders hundreds or thousands of products every month—can be pretty time-consuming. They say ‘If it ain’t broke, don’t fix it”, but we’re here to tell you that your invoicing system is broken—and teach you how to fix it.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

3 reasons you need 3-way matching automation

By using a platform that automates your 3-way matching, you are killing three birds with one stone. As a result, three more advantages present themselves. Your company can:

Saving time with 3-way matching automation

Think about it: when an unknown or unmatched purchase appears, that is an immediate red flag. Manpower and company time goes into investigating the charge, diagnosing the mistake, and reconciling the corresponding paperwork. With an automatic 3-way matching process, all that time is saved.

Saving money with 3-way matching automation

As the saying goes, time is money. But, not only does an automated 3-way matching system save you money with time, but it also prevents your company from paying for unauthorized purchases, otherwise known as “Maverick Spend”. When analyzing the true costs of maverick spend, it is not uncommon to find that up to 80% of a company's invoices are generated from uncontrolled purchasing. Read that again: 80%.

Sleeping easy with 3-way matching automation

Take the stress out of audits. By automating your 3-way match system, not only are all your invoices stored in one place, but your accounting team has human-error-free documents that are organized, easy to read, and ready to be reviewed. Sit back, relax, and enjoy your easy audits.

How Order.co’s 3-way matching automation helps companies thrive

Order.co’s automatic 3-way matching enables companies to scale their operations by eliminating the tedious process of reconciling invoices and approving payments.

With over a million invoices to process per year and a small AP team, WeWork estimated that, before Order.co, they would have needed to hire 150 AP specialists just to reconcile and process all of their invoices. Not only was their 3-way matching system confusing and time-consuming, but it was expensive—costing WeWork $20-$24 to manually process a single invoice.

WeWork has since been able to utilize Order.co’s automated 3-way match and invoice reconciliation feature—ridding WeWork of their manual invoice-to-payment process, ensuring accurate payments, and giving Finance Manager Kyle Ingerman and his team complete confidence in their AP process. The automatic 3-way purchase order match and invoice reconciliation process has been a “huge advantage and time-saver” for Kyle.

What Order.co Offers Accounting and Finance Teams

We put the balance back into balancing your books.

Order.co automatically matches your company’s POs, supplier invoices, and goods receipt—ensuring accurate payments, a simplified accounting process, and a streamlined P2P system. With 3-way matching, your company never has to worry about overpayments or ghost invoices ever again.

The way we see it, automatic 3-way matching is like the Advil for your accounting headache. Schedule a demo with Order.co today!

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Business success demands effective decision-making, on-time reporting, and accurate data entry. Still, sometimes errors enter the system—and poor invoice processing is a primary reason.

Users may not discover inaccuracies caused by an incorrectly processed invoice until they prepare the accounts payable (AP) trial balance. This leads to late reporting and delayed decisions. If no one discovers the errors, executives might make decisions based on inaccurate reports.

Accuracy in accounts payable trial balance is crucial. It positively impacts working capital to improve operational control and future planning. To demonstrate how your business can ensure an accurate trial balance and improve processing (so you can reap the rewards of control and planning), we discuss:

- AP invoice processing and AP trial balance preparation

- The value derived from improved invoice processing

- Nine common causes of inefficient, multi-site processing

- How accounts payable trial balance errors impact your vendors

- The solution for first-time-right trial balances and how Order.co helps you deliver them

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is an accounts payable trial balance?

The accounts payable trial balance—also called the accounts payable trial balance report—is a listing of the end balance in the chart of accounts. It includes subtotals for partial and unpaid invoices appearing on each general ledger (GL) account.

The AP trial balance enables accounting to post payable liabilities to the general ledger. Accurate and comprehensive inclusion of those payable liabilities helps the business reconcile initial journal entries, bookkeeping records, and sub-ledger balances with bank statements and other documents. The amounts are later totaled and posted to the correct general ledger account. They eventually appear as current liabilities on the balance sheet.

Trial balance and invoice processing: The main points to consider

The C-suite creates business success by ensuring all external and internal actions deliver intended results efficiently and accurately. Every aspect of corporate finance significantly impacts outcomes, particularly the AP process. While accounts payable is only part of the overall accounts structure, effective invoice processing is a valuable subtask to prioritize.

Invoice processing improves when your accounts payable account is accurate, fully inclusive, and timely. Therefore, accuracy and transparency become the norm across the entire accounts payable processing system. Together, they enable greater accuracy to support C-suite decision-making.

Here are some common positive outcomes of accurate accounts payable:

- Operations maximize working capital

- Companies allocate funds to spur growth versus maintaining current operations

- Vendor relationships improve

- Accounting team members work more efficiently

The value of improved invoice processing

Accurate invoice processing determines overall control of the accounts payable process. It enables AP teams to make the best use of cash and available credit within an accounting period.

Accuracy and timeliness, in many instances, come from adopting a comprehensive, automated AP system that offers validation and tracking for accounts payable, accounts receivable, expense account data, etc.

The gold standard is an automated AP system that handles daily transactions and produces the required management and financial reports for that accounting period, including the trial balance report.

9 Common pitfalls of multi-site AP processing

Businesses with several sites, functions, and divisions often create accounting process silos. Each site, function, and division has a separate bookkeeping system to record and account for its procurements and payments. This may extend to separate order approval, procurement, and accounts receivables processes.

Individual procurers in each location may have the same preferred vendors for products and services as other procurers. However, if they order separately, it duplicates efforts and robs the company of leverage.

Redundant and siloed ordering affects the business in several ways:

- Multiple invoices matching each order and delivery

- Maverick spend and budget waste

- Missed opportunities for bulk discounts

- Poorly negotiated terms and conditions

- More complex invoice processing

- Increased invoice exceptions and errors

- Potential for procurement fraud

- Higher overall spending and overhead

- Weakened cash position and credit access

Problems of interim trial balance reports

Beyond ineffective and decentralized purchasing, each site or function often prepares separate financial statements up to a predetermined level. For example, they may:

- Balance the accounts payable and receivable ledger accounts

- Produce separate (balanced or unbalanced) AP trial balance reports

- Have separate operating and P&L Accounts

Bookkeeping entries, account balances, and any supporting documentation go to the head office. They’re then summarized for the accounting period. After reconciliation, the AP teams use the balances to create an overall trial balance report before posting it to the general corporate ledger. Alternatively, the approved reporting system may require each site or silo to prepare basic bookkeeping figures to be aggregated at the corporate level.

A major and common problem for head office-based accounts payable processing teams is that any errors in the interim AP trial balance reports are difficult to locate once they extend to the corporate level. One silo’s accounts payable trial balance may appear accurate because its debits and credits balance out. An error within an account number may have gone unnoticed.

Alternatively, an error of commission in one liability account may be balanced by an error of omission in another. The net result is that the errors may remain invisible until a vendor’s invoice amount is underpaid, overpaid, or missed.

The immediate result of such mistakes is more research and corrections work for AP. This wastes time and creates inaccuracies in finalized financial reporting. Miscalculated payable liabilities in the general ledger are concerning since the executive team may base decisions on faulty reports.

The downstream effect of inaccuracies in any AP trial balance reports is payment delays for vendor invoices. A vendor that has accepted orders, shipped products or services to separate sites, and submitted accurate invoices should have a reasonable expectation of timely payment. Failure to pay because of internal AP errors may lead to delivery suspensions or renegotiation of credit agreements.

A balanced trial balance may still not be accurate

Balanced AP trial balance reports are a prerequisite for producing accuracy across siloed departmental and corporate general ledgers. However, balanced trial balance reports may still have equalizing errors of omission or commission concerning debits and credits.

AP trial balances may also have errors of principle, such as if a clerk incorrectly posts a vendor’s invoice for services or materials to a capital acquisition account. This can result from something simple like a misunderstood product code or mistyped account number.

Therefore, a trial “balance of balances” is not a guarantee of accuracy. As a result, it cannot be relied upon to prove there are no unbalanced journal entries or that the financial statements will be accurate.

How Order.co helps accounts payable trial balance reporting

Accurate and timely reporting is essential for businesses to achieve and maintain financial control and for the C-suite to make valid decisions. Improving preparation starts with making improvements in AP invoice processing.

The goal is for AP processing to be simple and accurate. That helps ensure trial balance reports are accurate before you enter data into the general ledger and publish the balance sheet.

By implementing a procurement solution like Order.co, businesses automate and streamline many of the processes that lead to more accurate invoices and AP trial balances, such as:

- Avoiding the nine pitfalls common to multi-site procurement and processing

- Increasing visibility to improve capital efficiency

- Improving vendor relationships through timely, accurate payments

- Operating a transparent, automated system—from product sourcing to invoicing and payment

To learn more about improving your AP processing with Order.co, request a demo.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Why accounts payable outsourcing is gaining popularity

As the business world becomes more competitive, companies continually look for ways to improve services and increase cash flow. Following the rationale that time is money, businesses use outsourcing to make the most of internal employee time.

The accounts payable (AP) department is a popular candidate for outsourcing. Many businesses and organizations turn over their accounts payable to specialized third-party teams to:

- Identify areas to lower costs and increase profit margins

- Enhance organizational efficiency

- Better manage cash flow and working capital

Outsourcing is popular, but it comes with some challenges alongside the benefits. What is the process for finding and implementing the best accounts payable solution for your organization? Is accounts payable outsourcing that solution?

This article covers:

- Why an in-house accounting staff is more expensive than outsourcing AP services

- The risks and rewards of outsourcing AP to specialized outsourcing providers

- Alternatives to AP outsourcing that offer its benefits without the drawbacks

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

What is accounts payable outsourcing?

Accounts payable outsourcing refers to contracting with a third-party team to manage your accounts payable process. In AP outsourcing, activities such as managing short-term debts and creditors are conducted by qualified third-party AP teams.

Other services you can outsource include:

- Accounts payable administration

- Accounts receivable management

- Discrepancy resolution

- Sending purchase orders

The best third-party teams manage your company’s basic AP functions. This frees your in-house AP department to focus on higher-level tasks and attend to the core business processes that enhance your company's performance and improve service levels.

AP automation vs. AP outsourcing

An alternative to outsourcing your AP function is implementing AP automation. AP automation is different from AP outsourcing in several ways. When you outsource accounts payable, a third-party company runs your AP department. With AP automation, your in-house accounts payable team uses a sophisticated platform to streamline your internal AP systems.

Essentially, AP process outsourcing transfers tasks and responsibilities to another company for efficient management. AP automation uses business intelligence software to manage your in-house systems (with lower total costs on your part).

AP Automation software frees up time spent on repetitive, manual tasks like invoice data capture, three-way matching, and paying vendors so that they can focus on more strategic work. This has several advantages, including lower costs, 24/7 operations, and lower third-party risk.

Why do companies outsource accounts payable?

If your business is making do with paper invoicing and optical character recognition (OCR) to manage your AP processes, you already know the challenges of outdated systems.

Upgrading old accounting systems to modern tools is costly and time-consuming. But evaluating your options with a complete understanding of what’s available leads to better business outcomes.

Let’s look at the pros and cons of outsourcing.

Pros of accounts payable outsourcing

Cost and time savings

Outsourcing AP tasks saves your company considerable money and time. According to recent reports, hiring one employee can cost as much as $4,425. Executive hiring costs climb even higher.

Such costs stack up quickly, especially for large companies. Outsourcing minimizes the cost and time associated with recruiting, hiring, training, and compensating additional employees.

Improved efficiency

Manual accounts payable processes are prone to data entry errors. Moreover, invoice processing speed is limited by your staff's abilities and work hours. Third-party accounts management companies have modern facilities and software to efficiently and accurately accomplish tasks.

Access to better tools

Third-party AP service providers offer professional teams and the latest software to do the job. When you outsource AP tasks to them, you gain access to excellent tools such as computer systems complete with customized invoicing, expense management, and other accounting software.

Reduced workload

Outsourcing accounts payable reduces the workload in your company. This leaves your AP team free to attend to the value-creation activities of the business.

Increased profitability

AP outsourcing solutions put efficient systems in place that allow you to pay vendor invoices on time (or even early) to enhance supplier relationships. A satisfied supplier may offer discounts due to early payments, thus increasing your profitability.

Cons of accounts payable outsourcing

Despite the benefits of using accounts payable outsourcing companies to relieve your internal accounts payable department, there are drawbacks to this approach.

Lack of process control

While it is easy to supervise an in-house AP team, the same cannot be said for third-party service providers. You cannot control how they handle your accounts or run back-office processes. This may hinder transparency, communication, and efficiency.

Difficulty reporting accounting errors

When it comes to outsourced AP services, error reporting can be problematic.

Since you are not physically present to supervise tasks, mistakes may not receive due attention. You may not even notice serious errors — such as duplication of invoice processing and exception processing — until it’s too late. Outsourcing may also make spotting payment fraud more difficult.

Third-party risks

Outsourcing may help your company cut costs and improve services, but over-dependence on third-party providers introduces more risk. If a third-party company experiences mismanagement or bankruptcy, it may disrupt your accounting services and affect vendor relationships.

Privacy and security concerns with accounts payable outsourcing

Outsourcing accounts payable data means sharing sensitive information such as BPO and bookkeeping details with third-party teams. This could create a potential gap in your business rules and data security systems.

Should you outsource accounts payable?

There is no hard and fast answer to the question of outsourcing, as the individual needs of your business, your AP volume, and the structure of your current processes will help determine the best course of action.

Outsourcing your accounts payable processes represents a significant time and monetary investment. Information collection, data centralization, provider selection, and implementation all require time and effort. When considering outsourcing, answer the following questions to get a better idea of your needs and what’s possible.

Do you need more flexibility? Outsourcing your accounts payable functions can give you the flexibility to quickly scale up or down, depending on changes in business needs.

Could you realize cost savings by outsourcing? If your current accounts payable process has considerable cash leaks or issues, moving to outsourced AP may improve budget optimization even after the cost of service fees. The average cost to process an invoice is as high as $15, and outsourcing or automation may offer up to a sixfold reduction in processing costs.

Do you have the internal support to make the switch? The move to outsourcing requires internal stakeholders to champion the project and take it to completion. It also requires buy-in from your finance and executive teams. Get an idea of the internal interest before making the move.

Could the increased efficiency of outsourcing help internally? Outsourcing allows you to focus on core operations while freeing up resources for other business functions. If your team can create value elsewhere in the business by moving to an outsourced AP model, outsourcing might make sense.

Will outsourcing improve operational costs? Some companies find that the cost of outsourcing is offset by the overhead savings created by delegating certain processes to an external provider. Conduct a cost analysis to determine if outsourcing your AP processes could improve efficiency and reduce operational costs.

Are there alternatives to AP outsourcing that could work? When considering a major change to your processes, it helps to explore all your options. AP automation (discussed later in this article) may provide the efficiency and visibility of outsourcing while allowing your company to maintain control of its processes.

Tips for successful accounts payable outsourcing

Choosing a reputable third-party processor is an essential step in reaping the benefits of outsourcing your AP tasks. Here are some tips to help you.

1. Research accounts payable outsourcing businesses

Choosing the best outsourcing companies may be challenging if you don’t know what to look for. Consider these tips when looking for the best team to partner with:

- Read reviews and testimonials of the company to see what previous or present clients say about them.

- Review the company’s previous projects to see if they meet your expectations.

- Use a security questionnaire or other supplier evaluation tools to understand the company’s data security and service-level processes.

2. Prepare your in-house team for change

Outsourcing requires several changes to your in-house AP processes. These include delegation of responsibilities, implementation of new software, and changes in the submission systems. Early preparation ensures a smooth transition to outsourced services.

3. Collect all relevant data for migration and cleanse it well

Well begun is half done, as the saying goes. Before implementing a move to outsourcing or automation, get your data in order to ensure you begin your new program with a clean slate. Take time to check and cleanse data for errors, duplicates, or issues that could hinder transparency in your AP processes.

4. Use performance tools to make sure your accounts payable outsourcing team measures up

The efficacy of third-party service providers is difficult to gauge without implementing performance metrics and measurement tools. You may never know if they are billing for idle time, accessing non-work websites, accurately reporting issues, etc., if you don’t set expectations and check that they’re met.

5. Implement change management for your project

Once you’ve got your automation or outsourcing project up and running, be sure to back up its success with a strong change management system. Streamline communication between all stakeholders: vendors, internal teams, and the finance department. Create documentation to outline how updates and changes will be managed. Provide a point person to address questions or concerns and keep everyone updated.

Consider AP automation as an alternative to outsourcing

Implementing automation software may be a cost-effective and reliable way to solve workflow issues within your AP function. Automation offers many benefits of outsourcing accounts payable without the liabilities of engaging a third-party team.

By implementing AP automation, businesses can:

- Improve internal processes without increasing or outsourcing the department

- Increase visibility through real-time data access and analytics insights

- Use accounts payable solutions that integrate with other systems, such as finance or ERP tools

- Create dynamic controls for every user, from departmental stakeholders to the CFO

- Implement well-designed workflows and purchasing processes unique to your business case

AP automation: Case studies and outcomes

There’s little doubt that accounts payable outsourcing and automation improve your organization through higher cost savings, better pricing, increased profitability, greater efficiency, and better data insights and tools. Automation offers all these outcomes without sacrificing the security or visibility of your AP process.

Order.co helps high-performing clients in diverse industries increase the efficiency of their procurement process.

ZeroCater: Using Order.co, this office catering company cut its invoice volume by 50x, improved its spend visibility, and eliminated organization-wide rogue spending.

SoulCycle: This well-known fitness brand streamlined processes across its 90+ locations by creating curated ordering with preferred vendors, implementing invoice consolidation, and improving budget tracking for better spend management.

XpresSpa: Using AP automation in its 50 locations helped the organization realize nearly 10 percent first-year savings, reduce its management approvals to 47 percent, and achieve 100 percent order compliance.

Streamline your AP process with Order.co

While accounts payable outsourcing is a viable option for some organizations, many can get the benefits of outsourcing while maintaining higher efficiency and security using a procurement platform.

- Order.co streamlines many accounts payable functions and offers valuable insight into procurement spending.

- It creates the efficiency of an outsourced solution while eliminating the uncertainty associated with third-party teams.

- Order.co also provides a centralized and dynamic ordering process that empowers teams to get what they need more efficiently.

To see how automation can improve your business outcomes with a scalable solution, request a demo of Order.co.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

![[eBook] How Automation Can Solve Finance Teams’ Biggest Challenges](https://www.order.co/wp-content/uploads/2022/09/finance-and-automation-ebook-640x480.jpg)